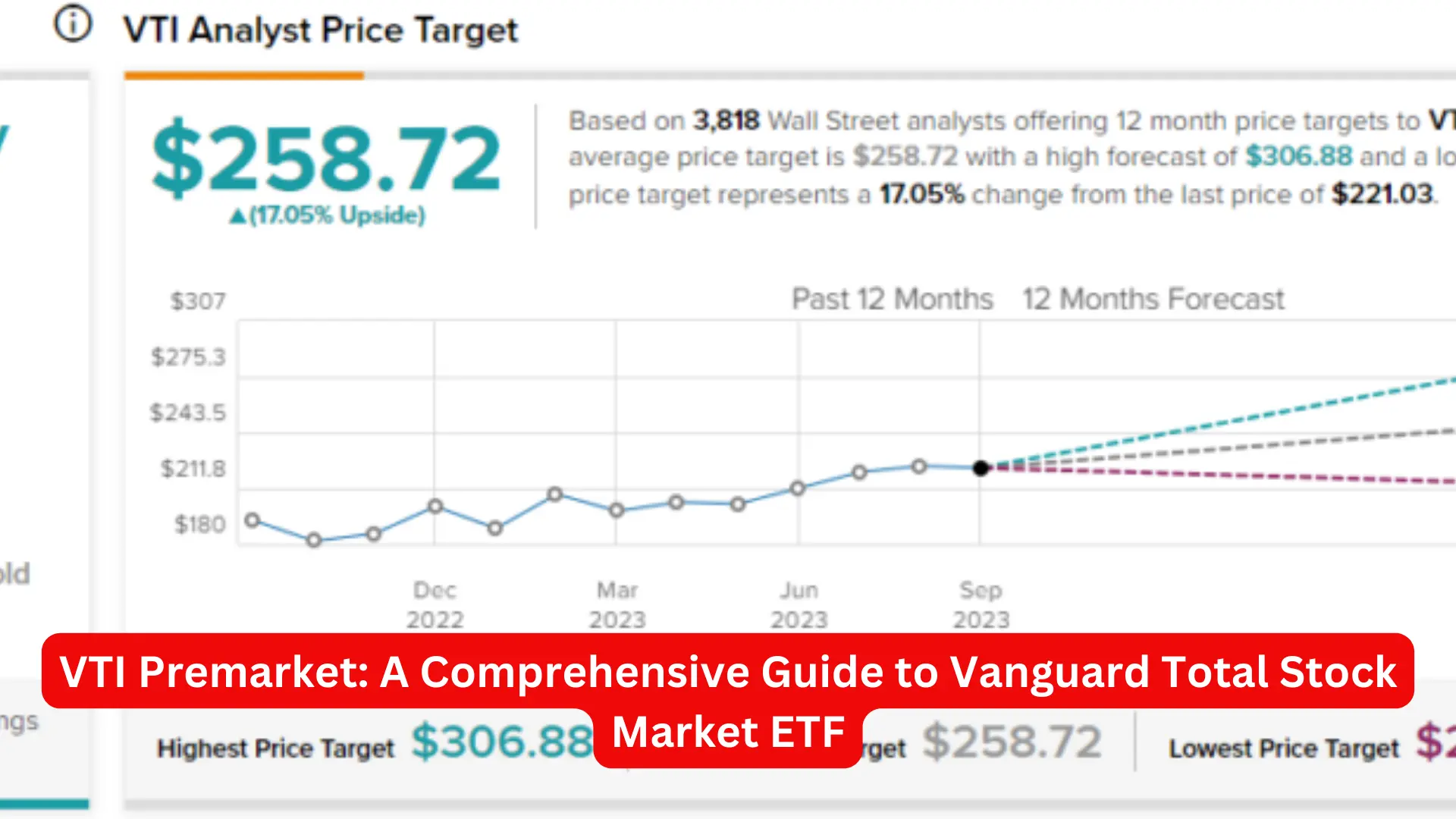

VTI Premarket: A Comprehensive Guide to Vanguard Total Stock Market ETF

Investing in the stock market requires meticulous planning and informed decision-making. One critical aspect that investors often consider is the premarket performance of ETFs. Among the most popular and widely traded ETFs is the Vanguard Total Stock Market ETF (VTI). Understanding VTI’s premarket activity can provide valuable insights for making strategic investment choices. In this article, we delve deeply into the VTI premarket, exploring its significance, factors influencing it, and strategies for investors.

Understanding VTI Premarket Activity

Premarket trading occurs before the regular market session opens, typically between 4:00 AM and 9:30 AM Eastern Time. It allows investors to react to news and events that occurred overnight, providing a glimpse into how the market might perform during regular trading hours.

Significance of Premarket Trading for VTI

- Early Market Sentiment: Premarket trading offers an early indication of market sentiment. By analyzing VTI’s premarket performance, investors can gauge the overall mood of the market and adjust their strategies accordingly.

- Reaction to News: Major news events, earnings reports, or economic data releases can significantly impact VTI’s price. Premarket activity reflects how these factors influence investor sentiment before the regular trading session begins.

- Liquidity and Volatility: Premarket trading is generally characterized by lower liquidity and higher volatility. Understanding these dynamics can help investors manage risk and make informed trading decisions.

Factors Influencing VTI Premarket Performance

Several factors can influence the premarket performance of VTI. By examining these factors, investors can better anticipate and respond to market movements.

Global Economic Indicators

Global economic indicators such as GDP growth rates, employment data, and inflation rates can impact investor sentiment. Positive economic news can boost confidence, leading to higher VTI premarket prices, while negative news can have the opposite effect.

Corporate Earnings Reports

VTI comprises a broad spectrum of stocks from various sectors. Corporate earnings reports, especially from large-cap companies within the ETF, can influence VTI’s premarket activity. Strong earnings results can drive up prices, while disappointing earnings can lead to declines.

Geopolitical Events

Geopolitical events, including political instability, trade tensions, and international conflicts, can create uncertainty in the markets. Such events can cause significant fluctuations in VTI’s premarket prices as investors react to potential risks.

Market Sentiment and Investor Behavior

Investor sentiment and behavior play a crucial role in premarket trading. Factors such as fear, greed, and market speculation can lead to price movements in VTI. Monitoring sentiment indicators like the VIX (Volatility Index) can provide insights into market expectations.

Analyzing VTI Premarket Data

To make informed decisions, investors need to analyze VTI premarket data effectively. Here are some strategies for analyzing and interpreting this data:

Using Technical Analysis

Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. Key technical indicators for VTI premarket analysis include:

- Moving Averages: Moving averages smooth out price data to identify trends. Commonly used moving averages include the 50-day and 200-day moving averages.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 indicates overbought conditions, while an RSI below 30 suggests oversold conditions.

- Bollinger Bands: Bollinger Bands consist of a middle band (a simple moving average) and two outer bands representing standard deviations. They help identify volatility and potential price reversals.

Fundamental Analysis

Fundamental analysis involves evaluating the intrinsic value of VTI by examining economic indicators, financial statements, and industry trends. Key factors to consider include:

- Economic Data Releases: Monitoring economic data releases, such as GDP growth, employment reports, and inflation figures, can provide insights into the broader economic environment affecting VTI.

- Corporate Financial Health: Assessing the financial health of companies within VTI’s portfolio is essential. Key metrics include revenue growth, profit margins, debt levels, and return on equity.

- Industry Trends: Understanding trends within key industries represented in VTI’s portfolio can help anticipate future performance. For instance, technological advancements or regulatory changes can impact specific sectors.

Strategies for Trading VTI Premarket

Investors can adopt various strategies to trade VTI effectively during premarket hours. Here are some approaches to consider:

Momentum Trading

Momentum trading involves capitalizing on the strength of a trend. If VTI shows strong upward or downward momentum in premarket trading, investors can enter positions in the direction of the trend. Key considerations include:

- Identifying Trends: Use technical indicators like moving averages and trendlines to identify strong trends.

- Setting Entry and Exit Points: Define clear entry and exit points based on technical analysis to manage risk and maximize gains.

News-Based Trading

News-based trading involves reacting to major news events that impact VTI’s premarket price. This strategy requires staying informed about relevant news and economic data releases. Key steps include:

- Monitoring News Sources: Stay updated with financial news platforms and official economic releases.

- Analyzing Impact: Assess how news events affect VTI and make informed trading decisions based on the anticipated impact.

Risk Management

Effective risk management is crucial for successful premarket trading. Key risk management strategies include:

- Setting Stop-Loss Orders: Use stop-loss orders to limit potential losses by automatically selling VTI if it reaches a predetermined price.

- Position Sizing: Determine the appropriate position size based on risk tolerance and account size. Avoid overleveraging to manage risk effectively.

Conclusion

Understanding and analyzing VTI premarket activity is essential for making informed investment decisions. By considering factors such as global economic indicators, corporate earnings reports, geopolitical events, and market sentiment, investors can gain valuable insights into potential price movements. Utilizing technical and fundamental analysis, along with effective trading strategies and risk management, can enhance the success of VTI premarket trading.